Thriday has dropped a new, game-changing small business financial management platform from stealth mode, blowing Xero out of the water.

Say goodbye to Xero, MYOB and other accounting software…Thriday has come through with a new, trailblazing small business financial management platform, generating a quantum leap in accounting and tax management.

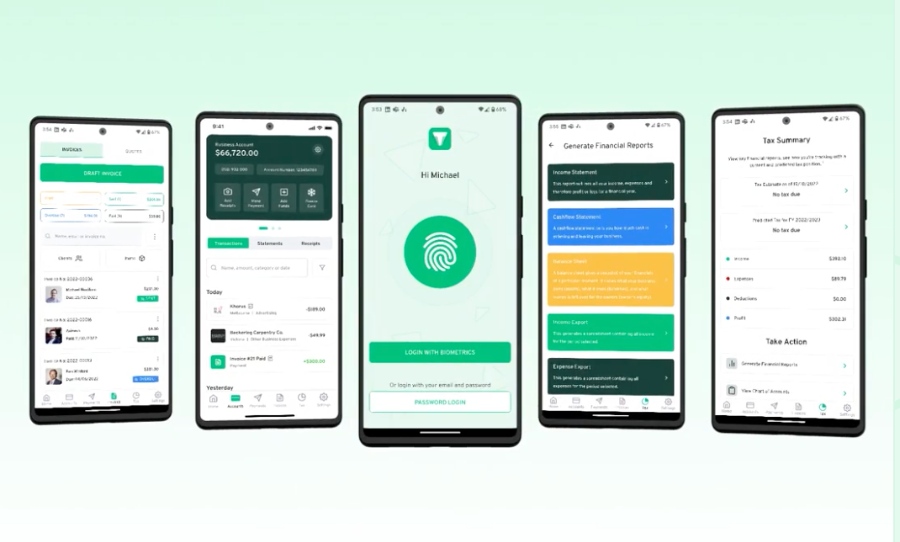

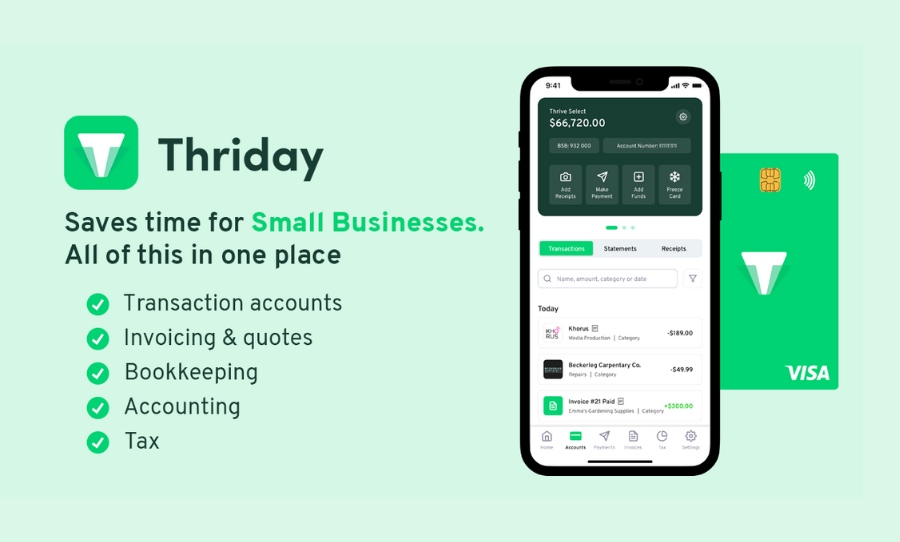

Representing 4th-generation accounting software, long heralded by experts as the “moonshot” of the industry, Thriday integrates all aspects of financial admin into one product, including banking, bookkeeping, accounting and tax reporting.

Unlike traditional accounting software, all financial management via Thriday happens in one place, in real-time, without the need for third-party apps or services. To put the company’s new offering into context, it’s important to understand the recent history of accounting in the Australian market.

Before MYOB launched in the early ’90s, accounting was paper-based. Most businesses had to resort to taking printed bank statements and a shoe box of receipts to their accountant for a face-to-face discussion about their books…

When MYOB came into the picture, the era of desktop-based accounting took off and MYOB was the dominant player in the local market. With MYOB, accountants could store their files on a computer and conduct a lot of the reporting they needed to produce.

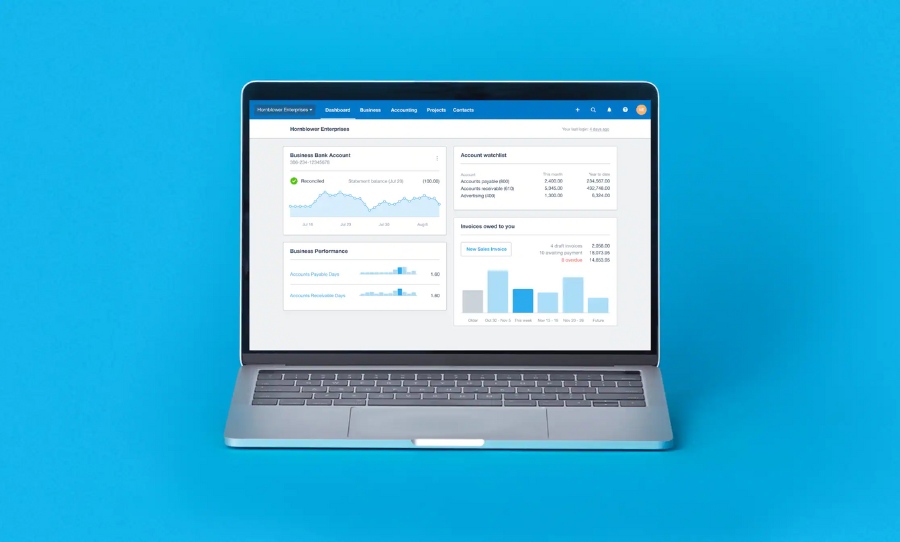

MYOB, however, was an accounting platform built for accountants, so it was difficult to use unless you had the required training and expertise. This meant that business owners rarely used the product directly themselves. In 2006, Xero took accounting to the cloud, and as result, launched the 3rd generation of accounting software.

Xero removed the need for an accountant and business owner to be chained to a desk, and improvements like bank feeds meant that getting a snapshot of everything that was happening in a business was much easier. Xero grew rapidly and was very popular with accountants.

Like MYOB, Xero was still designed primarily for accountants to use, and as a result, it can be complex to set up – data is not real-time, multiple apps need to be integrated and it’s hard to use. Thriday on the other hand has taken a completely novel approach to accounting that focuses on the small business owner.

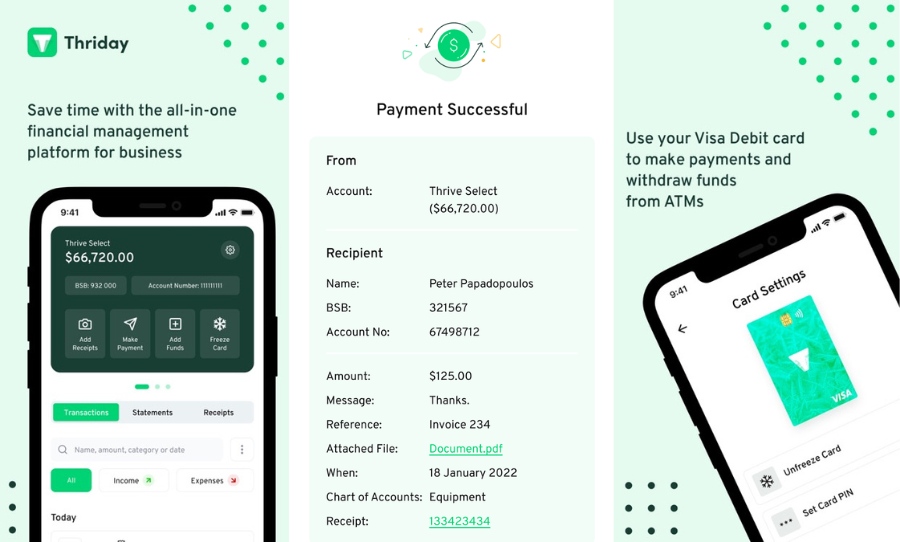

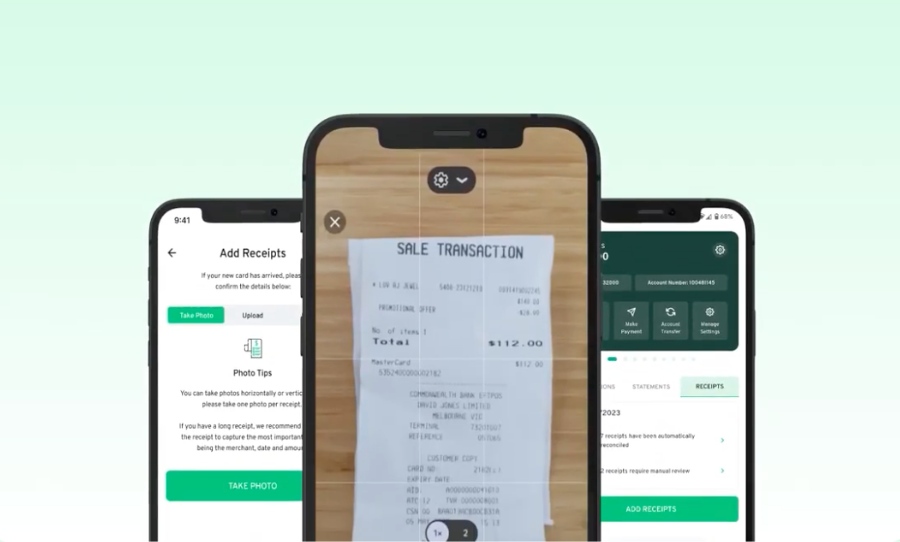

Using AI, Thriday’s unique value proposition is eliminating financial admin that currently relies on the business owner, a bookkeeper or an accountant to do. As customers transact and receive payments via their integrated Thriday business transaction account and debit card, data is categorised and fed into Thriday’s ‘bookkeeping engine’, which interprets the data, augments it with other third-party data, and determines the appropriate tax treatment for that income or expense.

With Thriday, there’s no need to reconcile data between different platforms, as everything is housed in one place. This not only improves accuracy and reduces manual handling, but it also saves business owners hours each week on financial admin. Using a combination of cloud computing, artificial intelligence and the latest machine learning technology, Thriday is a powerful and robust platform that does the books in real-time.

In addition to real-time accounting, Thriday also allows businesses to see their predicted tax and cashflow positions, as well as lodge their BAS to the ATO. Insights that are instrumental to making smart business decisions. Founded in 2020, Thriday launched a Beta testing phase before public lunch to test their product and incorporate feedback from small business owners.

Ben Winford, COO and co-founder, explained that Thriday was an idea formed from a very personal frustration: “With my last business, I would often find my ‘to-do’ list filled with financial admin tasks. I got fed up with the amount of time I spent on my financial affairs even though I had an expensive accountant and a bookkeeper.”

When the idea was first formed, the Thriday team identified that better utilising banking data was the key to unlocking the pain points that small business owners were suffering from. So, as customers transact and receive payments via their Thriday business transaction account and Visa Debit card, data is categorised and fed into the ‘Thriday bookkeeping engine’, which interprets the data, augments it with third-party data, and determines the appropriate accounting calculations and deductions for that business, in real-time.

Michael Nuciforo, CEO and Co-founder, confirmed that Thriday combines everything into one: “It’s ironic because accounting software, such as Xero and MYOB, relies on data from your bank to determine your profit and loss and income statement. Then your bank relies on accounting data to decide if they want to lend to you. The underlying data, your transaction data, is the same.”

Our limited-time offer of just $199 gets you a one-year subscription to Thriday has been extended for Cyber Monday. Act now and take advantage of this amazing deal!🤑https://t.co/FjnlQYsAFP pic.twitter.com/CeyPPFfO9i

— Thriday (@thridayau) November 27, 2022

Thriday believes that in the future, it can fully automate the financial management of a business. Nuciforo added, “because we can determine exactly what transaction has occurred, what GST was added, and what tax implications it has, we can then automatically calculate your tax, BAS and cashflow position. It’s like having a personal financial assistant.”

In a recent survey of 250 Thriday customers, 85% of respondents ‘agreed’ or ‘strongly agreed’ with the statement, “managing my banking, accounting, tax and payments in one place is much easier” and 66% said they would be “extremely disappointed” if they could no longer use Thriday.

To put any security concerns at ease, Thriday has partnered with Regional Australia Bank and Visa, under a ‘banking-as-a-service’ agreement. This means that the Thriday business transaction account is insured up to $250,000 per account holder, as the funds are held with an authorised deposit-taking institution (ADI).

To celebrate its launch, Thriday is offering a special discount to new subscribers! If you’re a sole trader, you can sign up for 12 months and only pay $199.00. This represents a 45% discount to a normal plan. Sole traders can sign up here.

Thriday has totally reimagined how businesses should manage their money, creating a unique product that uses artificial intelligence to automate banking, accounting, and tax for small-to-medium businesses. Thriday acts like a CFO in your pocket, taking care of everything a business needs. So, what are you waiting for? Check out Thriday today!